I have been tracking this company since some time now and in the face of pandemic the company has performed extremely well in the past 9 months! Although market cap has bounced in the past 1 year or so it had fell below 100 cr :(, this short post is primarily on how the company would perform in the next 5 years.

Source: Screener.in

Although, there has been a multi year stagnation here but the company is currently a net cash company with robust expansion plans. Till this quarter company was dealing in Phthalocyanine Pigments namely Pigment Blues. More on what is Phthalocyanine (here). Company has a 5% market share in Phthalocyanine Pigment (11,400 tonne pa capacity) of global organic pigments showcasing how niche the segment is with few large players like BASF, Clariant, Sun Chemicals alongwith growing companies like Sudarshan controlling the market. ‘Organic pigments are mainly applied in the ink (50%), paint (25%), plastics (12%) and rubber (10%), four areas with other areas only accounting for about 3%’ (Link)

5 year Revenue Stagnation post its expansion in 2010. (Link)

Company announced a JV with Irish company TTC (4500cr+ revenue) in October 2019 to venture in Azo Pigments (Subset of Organic). {Detailed usage 101 on azo pigments here}. TTC although a giant but was losing out on exports from China and India in this segment. China has been the key player in azo pigments-

Initially 2400 tonnes is to be commercialised with aiming to double going forward. Given the handful of companies in the segment and looking at how Sudarshan Chemicals has gained 35% market share domestically over the years it is indeed an inflection point for Asahi Songwon.

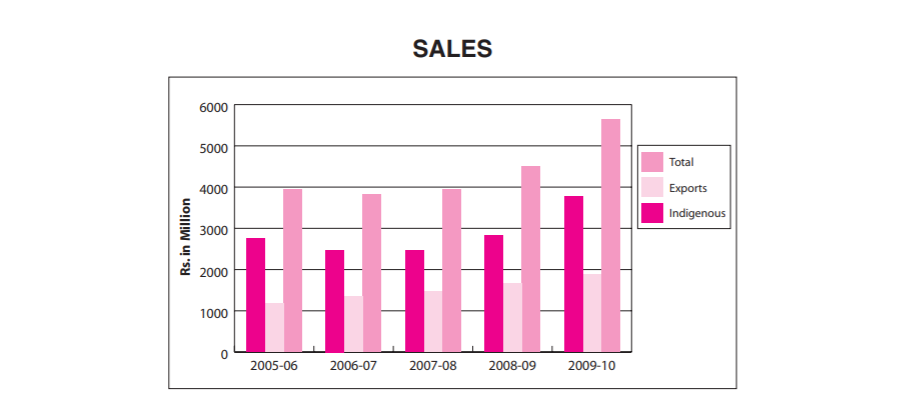

Sudarshan Chemical’s journey has been somewhat similar -

A phase of stagnation until a thrust in 2009-10 in numbers. Market cap wise it was a even bigger lull given how all types of chemical companies traded at single digit multiples until now wherein 30+ profit multiples are taken positively. It has from there grown to a 3800 cr mcap company with even more expansion plans ahead. Sudarshan is not present across the pigment chain-

Given Asahi’s robust commitment to sustainable production, good corporate governance practices, strong clientele, the current partnership with TTC would further its overseas revenue and improve product mix. With limited debt on it’s balance sheet it is well poised to double its revenue in the next 4-5 years. It’s environmental efforts can be read on another blog (Link)

Lot of queries even the previous note on ABB Power on the right time to buy. To reiterate this is not an investment reco note nor are the previous ones. Buying is an eclectic mix of portfolio, time frame, Expectations which unfortunately is not quantitative alone. Long form company notes are on long term business potential and result based update denote short term surprises. If there is a company you think I should cover do reply to this post. I do not have a team to vet these posts so there might be few errors here and there, would be happy to rectify once notified.

The newsletter/blog has crossed 700+ subscribers, do share :), although I did fell short of few coffees last time, here is another chance ;)

TTC Corporate Video-