CL Educate

Turnaround via Acquisition

There have been multiple attempts from the company to eliminate non-core businesses and streamline existing ones. The acquisition of DEX could have changed the fortune as that itself could be worth the current EV of biz. The EdTech business is tactically adjusting to shifting student habits, MarTech is retooling for AI-led growth, and new niches like weddings could surprise on the upside. Execution over the next 12–18 months will decide whether this is remembered as a breakout acquisition story or a debt drag cautionary tale. I am more in favor of the former.

Notes from latest results and concall-

📊 Consolidated Performance at a Glance

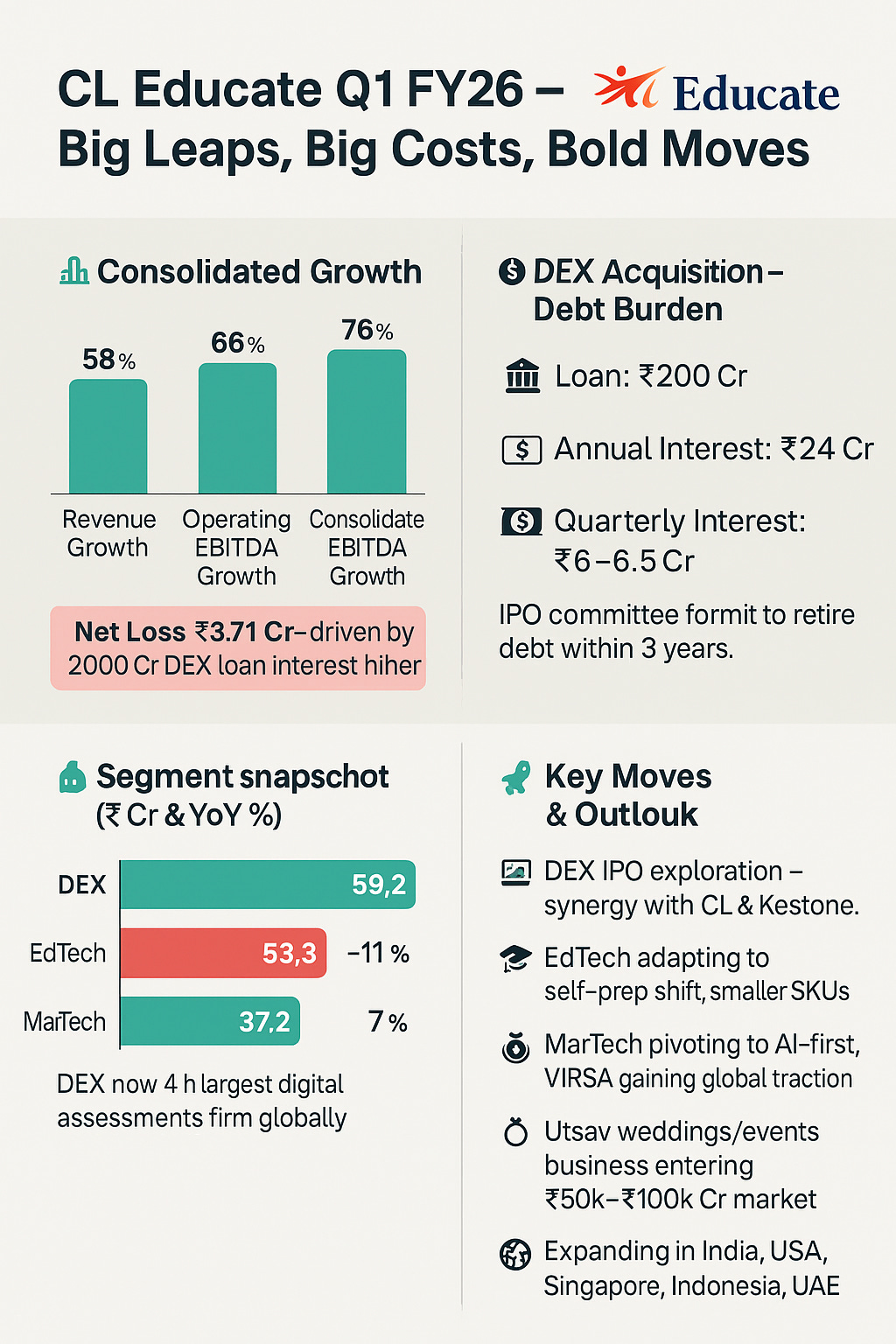

Revenue: ₹149.84 crore (+58% YoY), with operating revenue up 56% to ₹145.68 crore.

Operating EBITDA: ₹17.5 crore (+66% YoY).

Consolidated EBITDA: ₹21.7 crore, up 76% from last year’s ₹12.3 crore.

Net Loss: ₹3.71 crore — largely due to finance costs ballooning to ₹12.72 crore (from ₹0.72 crore a year ago), following a ₹200 crore loan for the DEX acquisition. Depreciation also rose sharply to ₹8.74 crore from intangible assets and DEX’s own asset base.

Loan Impact: Annual interest bill ~₹24 crore (₹6–6.5 crore per quarter).

Standalone CL Educate: Revenue fell 9% to ₹77.01 crore, EBITDA down 33% to ₹5.17 crore, net loss at ₹4.55 crore.

🚀 Dexit Global (DEX): The Game-Changer

Revenue: ₹59.2 crore (+54% YoY).

EBITDA: ₹12.8 crore — more than double last year.

Global Standing: Now the 4th largest standalone digital assessments company in the world. Over 55 million assessments completed till March 2025; 1.7 million in Q1 FY26 alone.

Key Wins:

₹24 crore deal with the Ministry of Ayush

₹14 crore renewal with IIBF

₹15 crore contract with NISM

Ongoing work with IRDAI, DGT, NTA, ICAI

Looking Ahead: An IPO committee has been set up to explore a listing within 3 years — with the aim of retiring the ₹200 crore acquisition loan.

📚 EdTech: Navigating Market Shifts

Revenue: ₹53.3 crore (–11% YoY).

EBITDA: ₹6.4 crore (flat YoY).

Headwinds:

Shift in MBA prep towards self-study models.

CUET leaning more towards self-prep vs. classroom formats.

Response:

Launch of smaller-value SKUs and test series/self-programs priced at ₹5,000–₹8,000 to maintain student volumes.

Growth in BBA & IPM billings (+12% YoY); law intake steady.

"AFA" (Anywhere From Anywhere) hybrid model rollout; new CL Mobile App (MBA live, other products coming).

DEX synergy in action: Online CAT test conducted via the DEX platform.

Publishing & Platforms: EasyApply App and web portal scheduled for August 2025 launch.

💡 MarTech (Kestone): Laying the AI Tracks

Revenue: ₹37.2 crore (+7% YoY).

Strategic Pivot: Moving to an "AI-first" model by year-end — expected to boost margins from FY27.

Digital & International Push:

Digital/tech revenue: ₹9 crore in Q1

International revenue: ₹12 crore

On track for 50% of total revenue from international, tech, and digital streams.

VIRSA Momentum: AI-driven lead-gen tool attracting big names: Salesforce, Infosys, Redington. Salesforce may roll it out in LATAM & North America. Pilots with Corestack & HP underway.

New Vertical – Utsav: Weddings & social events business gaining traction — 5 weddings booked till March; tapping into a ₹50,000–₹100,000 crore market.

🔍 Strategic Moves & Outlook

Portfolio Pruning: Dropped NEET, IIT, Bank SSC prep to avoid NTA contract conflicts.

361DM: First EBITDA-positive quarter in years (₹8 lakh).

Synergy Play: Actively integrating CL, DEX, and Kestone capabilities — benefits expected to show up over the next 2–4 quarters.

Global Ambitions: Expanding footprint in India, USA, Singapore, Indonesia, UAE.