Past 12 months have been tough for all of us, especially for noob cooks like myself. Run down the kitchen with a learnt recipe but we know not the correct Pigeon, butterfly, hawk to choose quite daunting our prestige. Moving away from the traumatic puns, it really bought us closer to few of these kitchen appliances, not a proud moment but a starting point. Back to the blog and its purpose to enlist or write on companies not tracked enough. This time around I thought of writing on the recently listed Stove Kraft.

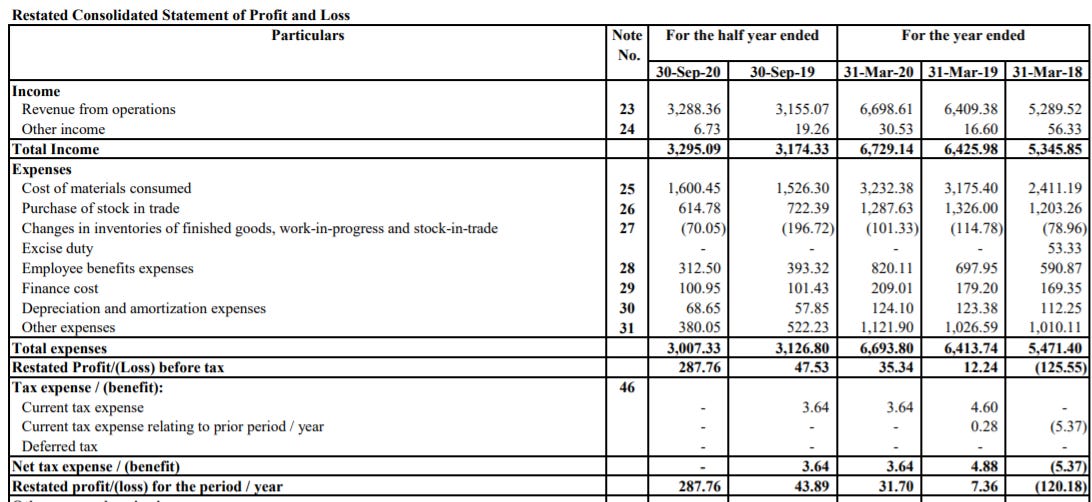

I do hate crunching too many numbers trying to study a business/stock, odd given I spent most of the life learning how to do it but the exercise turned counter productive most of the times. Coming to numbers, the past performance of Stove Kraft-

For 9 Months ending 2021, the company posted sales of 623 cr with a PAT of 62cr. It might end FY21 with 800cr+ revenue.

Although, companies showing startling improvement right before IPO has always puzzled me but given the kitchen experience I assume there was some reason for the margin and number thrust here. Before the positives, post Sequoia’s investment in 2010 the company posted stellar numbers and then crumbled in 2013 owing to trying to cater to political orders down south ! Trademark infringement by an associate PAPL company where MD Rajendra Gandhi is a director is another flustering event with a deadlock between both directors of PAPL.

The company has come a long way since 2013’s turn of fortunes and although it did show losses in some years primarily due to IndAS revised norms on CCD measurement. From 2015-20 the company’s sales and margins were hindered owing to the OMC Co-branded sales push and trying to build a brand play alongside. The company posted subdued margins of 5% in FY20. With a 22% sales growth expected in FY21 on back of heightened demand and cost savings across verticals, company would end FY21 14% margins. Considering the cost savings to be temporary a large thrust of operating leverage would play out hereon given the debt is paid off with IPO proceeds.

Bifurcation of business-

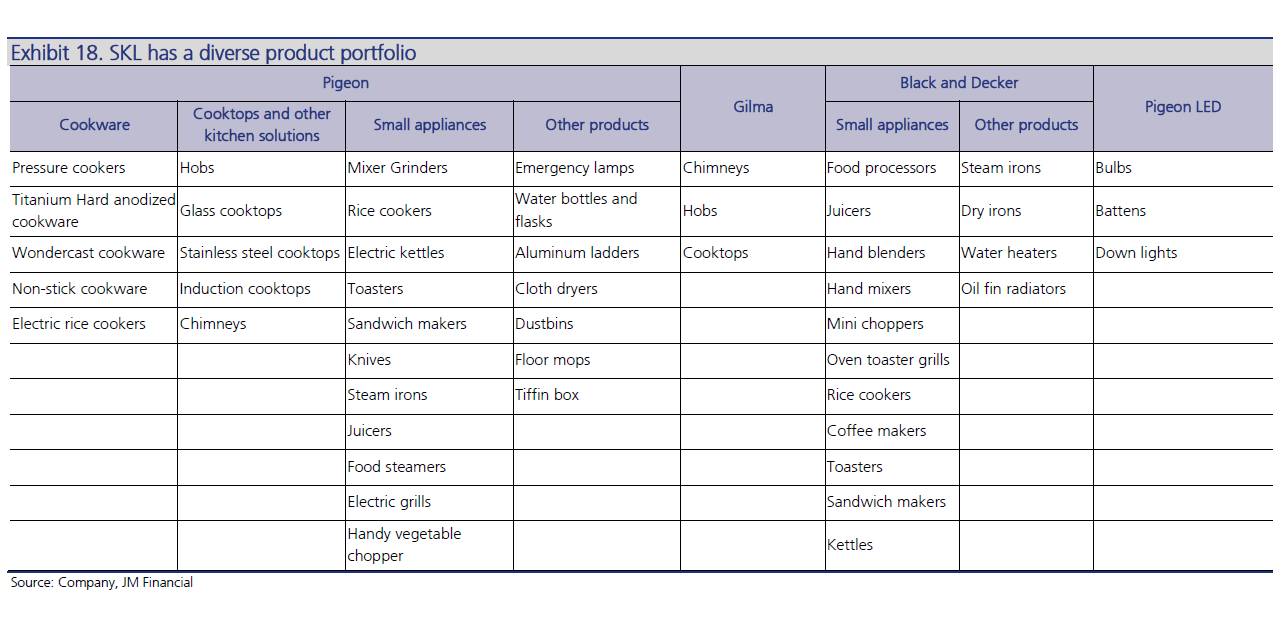

Stove Kraft has 2 brands and a brand licensing agreement-

Pigeon(Value for Money) - 85% + sales with 600+ SKUs available at 15-40% discount to brands like Prestige etc sold across 30k+ dealers. Pigeon LED products are 5% of sales with presence across just 6 states.

Gilma (Sub-Premium/Masstige) - 2.5% of sales with 65 franchise outlets all in south India

B&D(Premium) - 2.5% of sales sold in 9 states across 1k retailers. (Licensing Agreement)

Exports- 10% of sales primarily white labeling for large retailers. Company plans to grow its overseas branded biz as well.

Source : JM Financial Report

The company along with its large distribution and servicing network is utilising ecommerce way better than most companies in kitchen/home appliances with 30% sales from online not only helping quick product launches but also helping it widen its offline footprint.

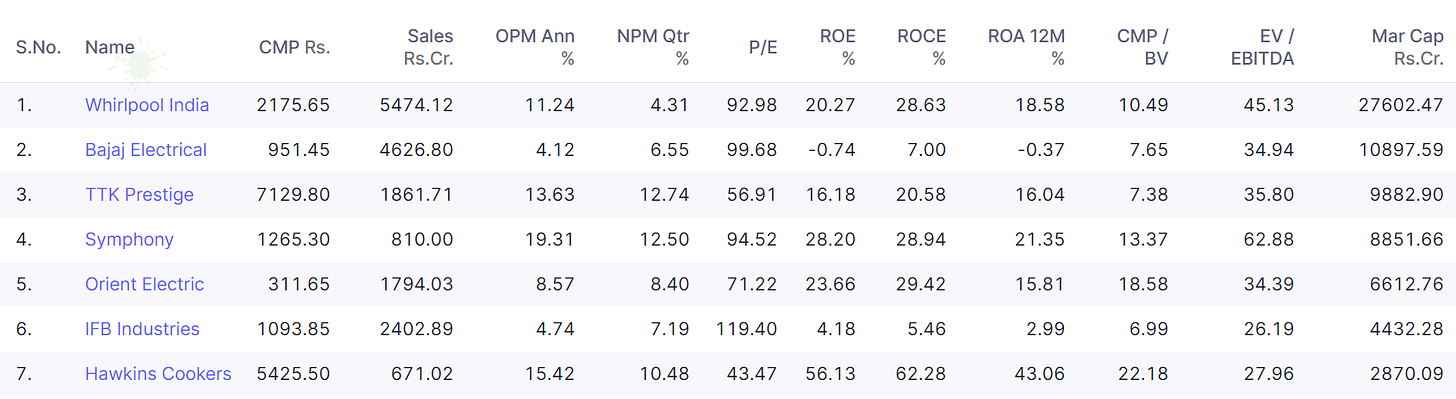

So there is an eclectic(I think so atleast!) mix of improving product mix, brand diversification, in-house manufacturing and high op-leverage. Given the rather unique positioning of growth, difficult to fathom the rather egregious price multiple compared to peers. Only reason could be anchoring to past and all story tellers have flocked to contract manufacturers and CDMO players.

Trailing numbers of peers (Source: Screener)-

Once the margin concerns are allayed (need to watch for few quarters), stove kraft multiple expansion head room seems significant given Stove Kraft’s market cap is 1500 cr with there being a decent probability of it clocking an EBITDA of 150cr within 2 years?

To put it in a nutshell some key positive points-

Kitchen Appliances market to grow at 10%+ . Unorganised to Organised might be over written about and so is premiumisation but both themes will play out gradually.

80% in-house manufacturing with a reasonably backward integrated plant with 38 mn unit capacity.

Reduced Debt, will be net cash by FY22

RM Cycle Peaking (No clue where the end is)

Low Margin Biz Eliminated (OMC driven)

E-commerce prominence will aid faster growth in online as well as offline.

As per management, SKL is currently operating at 2x of its breakeven level post which 80% of its gross profit flows through to EBITDA. (JM Report)

30 acres of free land at its Bangalore facility for future expansion

CEO Rajiv Mehta with a strong background in scaling brands.

What could go wrong-

Working capital mismanagement like past.

Margin compression and inability to change product mix.

Growing slower than industry