Transchem Ltd

Next Zerodha or Groww?

It has been a tumultuous year for micro and smallcaps to say the least. Stocks have been whacked on multiples, troubled on growth parameters, and tortured on market cap. A parallel bull market bloomed in commodities crippling the hopes of newly crowned bulls from 2020. Microcaps have always been volatile irrespective of market sentiment or global macros, but in such troubled geo political environment they behave like a herd wanting to jump off the cliff. In such times, it makes sense to hunt for new ones which would give enough time for ‘buy and study’.

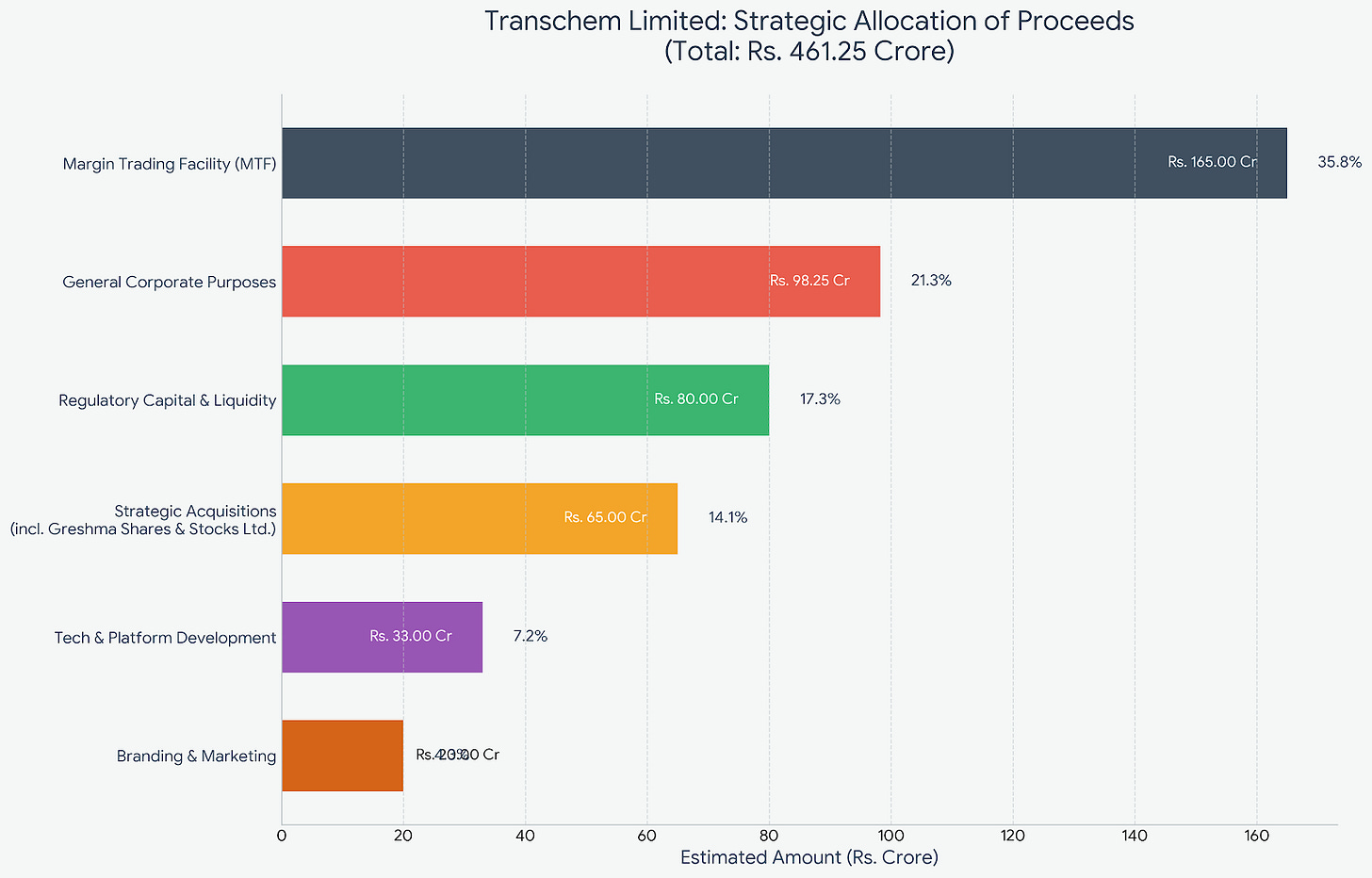

Change in managements and takeovers are always fun and more so in such doomsday conditions. Transchem Ltd a company with no operations announced a massive fund raise to the tune 461 crore! The use of funds led me to dig deeper on the key acquirers dynamic strategy with a broking license to be acquired as key target-

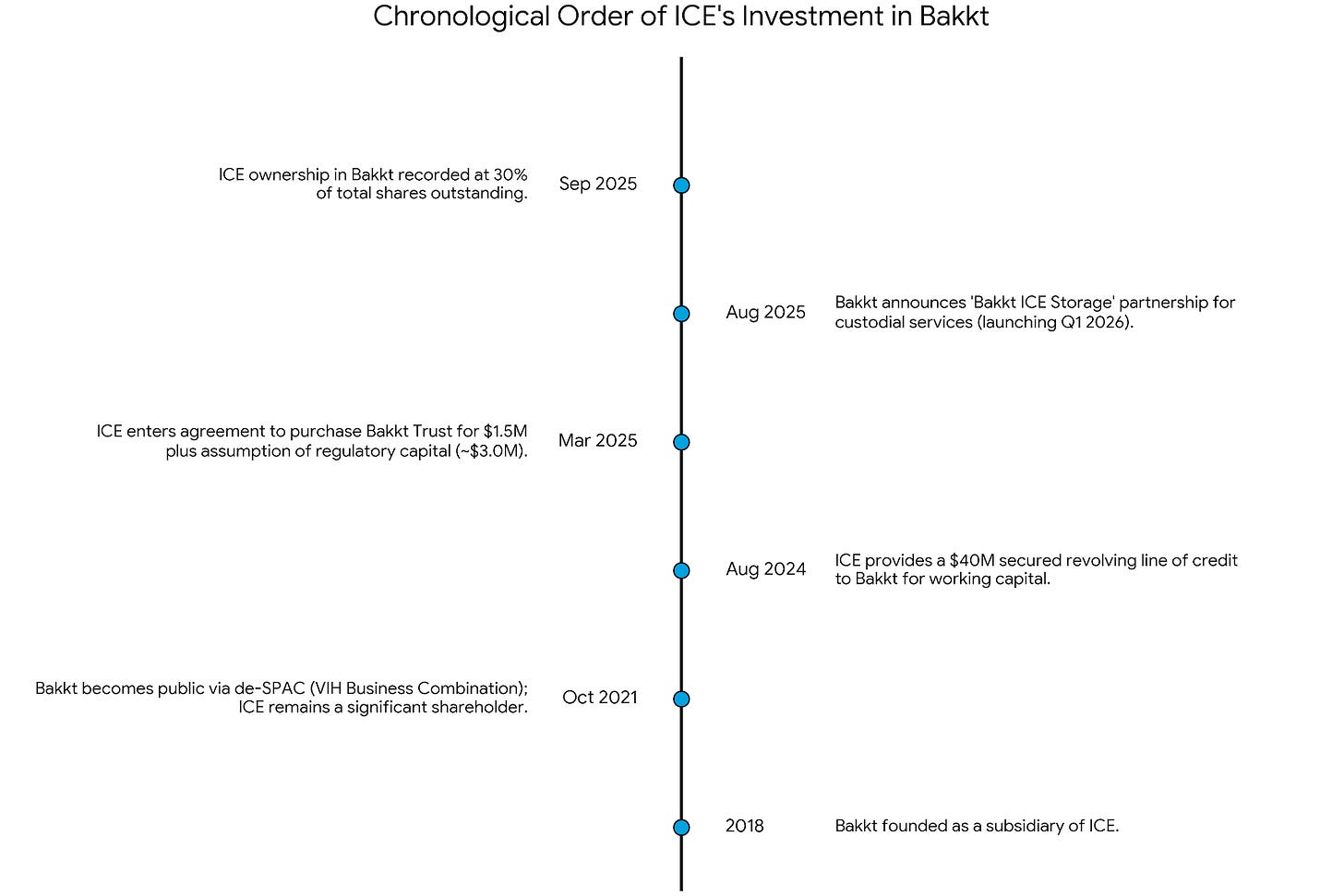

This was more than 5x of its market cap in November. The amount of infusion is not the biggest surprise here, the lead investor of the consortium is NYSE listed Bakkt Holdings (via its subsidiary). Bakkt Holdings journey has been a roller coaster ride with Intercontinental Exchange (ICE) holding ~32% of the company as of now. ICE(holding company of New York Stock Exchange) had formed Bakkt to catch on to the crypto mania but with a changed strategy and rounds of dilution, it is an associate company. Current Market cap of ICE is $100bn and of Bakkt is $350 million. Although Bakkt is a miniscule part of ICE, it originates from a very strong ecosystem-

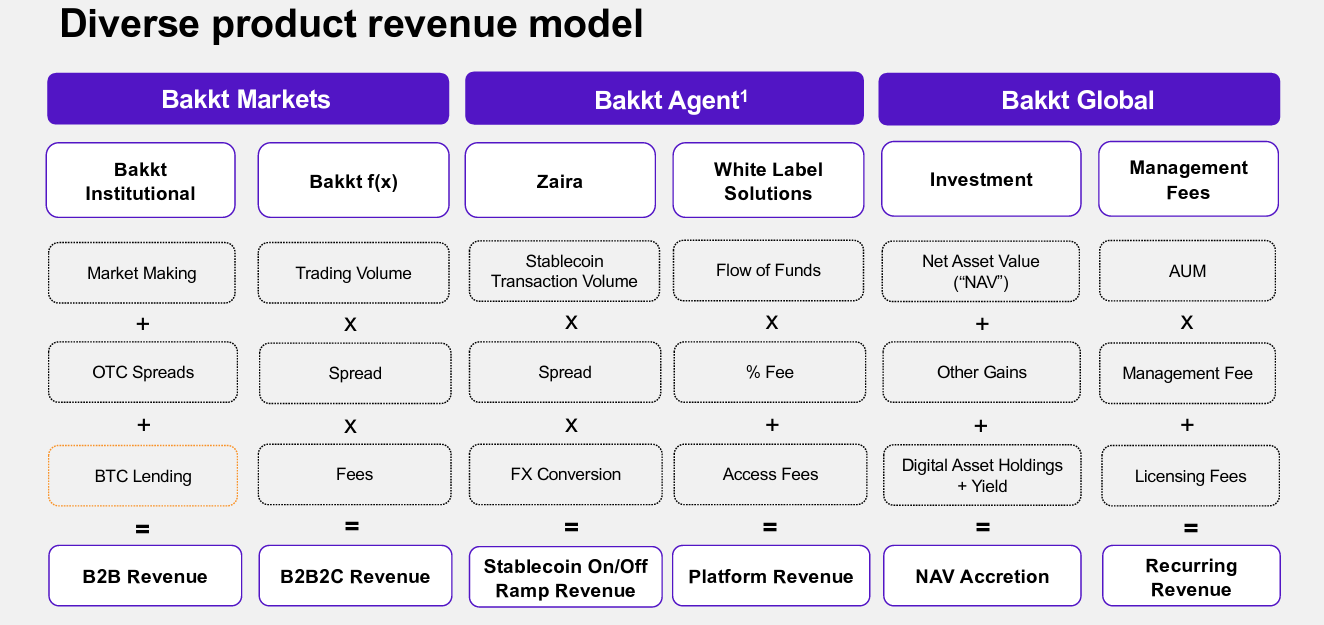

Bakkt Holdings is a global digital asset infrastructure company with core mission being -

The large outcome that Bakkt is gunning for -

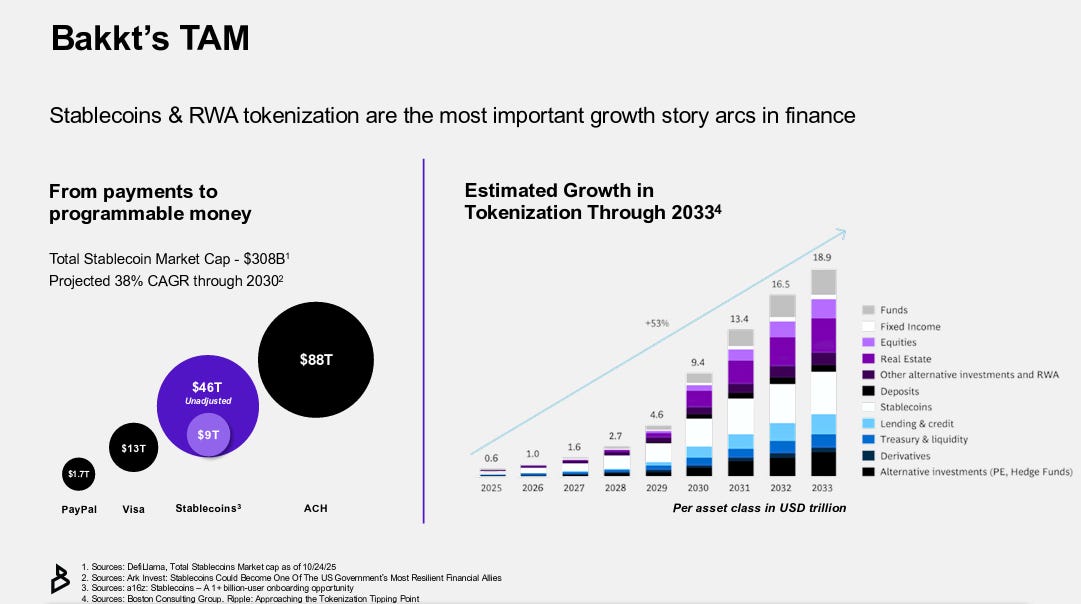

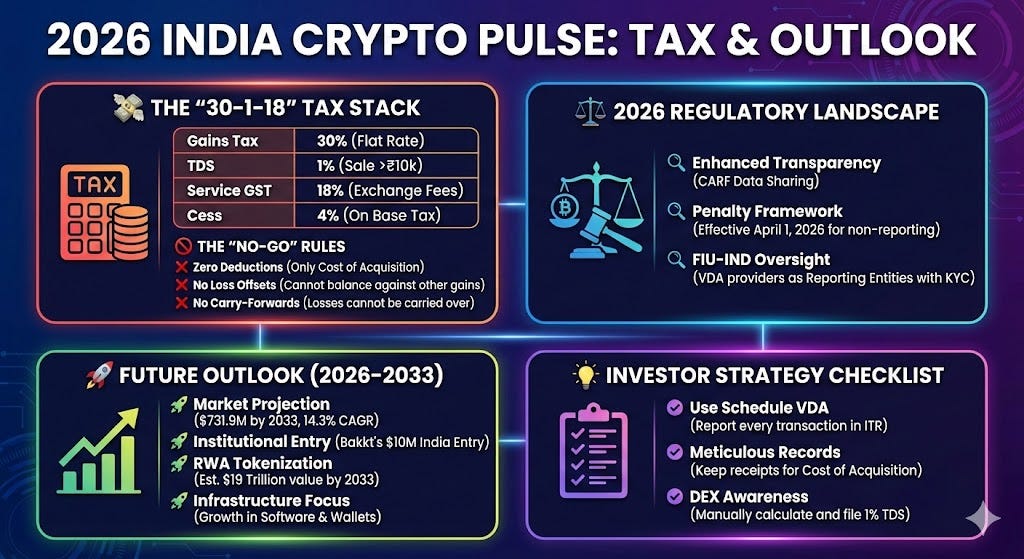

India’s crypto dreams did come crashing down, at least what everyone thinks with the government taxation policy, but practically the government has only curbed the speculative end of crypto while opening up the stablecoin and tokenization world!

What is the world saying about onchain finance -

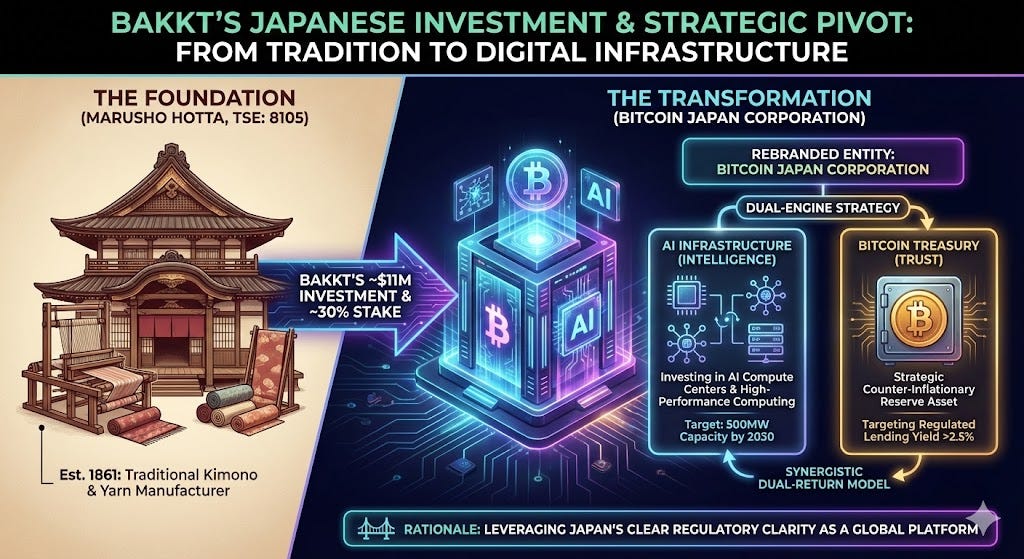

Another important part of Bakkts global footprint is to expand in geographies like India, Japan and Korea and widen the digital rails-

Bakkts $115mn Japanese investment(MHT) is rather unique with regards to it being a listed bitcoin treasury company. The aim is big and audacious but seems to be on track to earn from ancillary services due to rise of AI and tokenisation-

Akshay Naheta, CEO of Bakkt, commented, "Japan's regulatory environment creates an ideal platform for a Bitcoin-centered growth business. We look forward to working with MHT's team to integrate Bitcoin into their operating and financial model and to establish MHT as a leading Bitcoin treasury company."

Short Video on their Japanese dreams-

More on Bakkt’s CEO Akshay Naheta, he has had a great career at SoftBank as group SVP and quit his investment career to join the tokenisation of assets world at DTR and then joining Bakkt-

India’s broking industry has seen a roller coaster market share movement with traditional brokers shifting gears to the battle between Zerodha and Groww, what we still lack is a global platform to invest have a multi asset strategy which is what the next gen is looking for and with the ban of RMG this seems an apt time to launch a global product in India. Interesting micro cap for all of us to track, although with the infusion at Rs.75 on a fully diluted basis that infusion is worth 800cr thus the total effective post money valuation is above 1k cr, but the rails to this journey appear to be long enough.

As the company takes further steps, we will dive deep into onchain finance and the disruptions around it in part 2 of the transchem blog.